In the past decade, what began as grassroots digital competitions has evolved into a global entertainment juggernaut. Esports is no longer a fringe niche, it is rapidly transforming how the world watches, plays, and engages. Below, we explore the forces behind its rise, the current scale of the industry, and what it means for media, brands, and adjacent sectors.

Market Scale & Revenue Trends

One of the clearest signals of esports’ growth is its expanding financial footprint.

-Global esports revenue in 2025 is projected to reach USD 4.8 billion

-The U.S. market is projected to contribute about USD 1.2 billion in 2025

-The Asia-Pacific region approximately USD 2.3 billion in 2025

-Europe around USD 0.8 billion in market value by 2025

-Latin America is anticipated to contribute close to USD 0.3 billion in 2025.

-The Middle East & Africa region for roughly USD 0.2 billion in 2025

-From 2025 to 2029, revenue is projected to grow at a CAGR of 5.56%, reaching approximately USD 5.9 billion

-Within that total, esports betting stands as the largest individual segment, accounting for an impressive 47.5%, or around USD 2.8 billion in 2025

-The global esports user base is forecasted to grow to 896 million users in 2025, representing a 12.5 % penetration rate, and will reach 14.2 % by 2029

-Average revenue per user (ARPU) is projected at USD 6.19

These figures suggest that esports is consolidating into a major revenue engine, one increasingly defined by its scale, digital reach, and the influence of betting as a major sub-segment.

Viewership, Engagement & Platform Trends

Revenue tells one side of the story, the deeper driver is engagement.

-In 2024, streaming platforms recorded 32.5 billion hours of esports and gaming content viewed globally, a 12 % year-over-year increase.

-Live viewing continues to expand, with Twitch maintaining leadership (around 60 % of all esports viewership) while YouTube Gaming, Kick, and others rapidly gain ground.

-The high engagement levels show the “stickiness” of esports content: viewers watch longer, return more frequently, and interact more intensely than audiences in many traditional entertainment formats.

Where to Watch: Platforms & Market Share

Esports consumption is anchored by a handful of powerful streaming platforms that dominate the global market.

-Twitch: around 140 million monthly active users, generating roughly USD 0.06 billion in esports-related revenue.

-YouTube Gaming: about 120 million monthly users, contributing around USD 0.04 billion.

-DouYu: approximately 85 million monthly users, a dominant platform in China, generating USD 0.03 billion.

-Other significant channels include Bilibili, Kick, Facebook Gaming, and TikTok Live, each holding regional importance and adding diversity to the ecosystem.

Combined, these platforms generate over USD 100 million in esports-specific revenue and serve as the backbone of global esports visibility, audience building, and sponsorship activation.

The Fanbase: Digital, Active, and Evolving

The global esports viewing audience is projected to reach 640.8 million viewers by 2025, representing one of the most engaged digital audiences in the world. The broader esports user base, including players, viewers, bettors, and participants in esports ecosystems, will reach 896 million the same year.

Esports fans skew young and digitally native:

-The 18-34 age group represents over 60 % of total viewership, with adults up to 44 forming the secondary segment.

-Average weekly viewing time often exceeds 4-6 hours, with fans highly active across chat, clips, and social platforms.

-Mobile viewership continues to rise, driven by accessibility and global connectivity.

Gender balance also reflects both progress and opportunity:

-Women comprise 47 % of global gamers and 33 % of esports viewers (as of 2024).

-The increasing share of female fans, particularly in mobile-first regions, highlights the industry’s growing inclusivity and potential for expansion.

-For iGaming brands, this shift presents a strategic opportunity to engage a largely untapped female audience, expanding beyond their traditionally male player base.

Esports audiences are not passive, they co-create content, engage directly with creators, and drive community interactions that make the ecosystem constantly active and self-sustaining.

Institutionalization & Ecosystem Sophistication

Esports has evolved from loose online competition into a structured global industry that mirrors, and in some areas outpaces traditional sports.

-Major publishers like Riot Games, Valve, and Epic oversee official competitive ecosystems, enforce rules, and license media rights.

-Leading teams such as Fnatic, NAVI, Team Vitality, FaZe Clan, and GiantX operate as multimedia brands, producing content, managing sponsorships, and expanding into merchandise and fan engagement.

-Sponsorships, media rights, and performance-based revenue have become the backbone of esports business models.

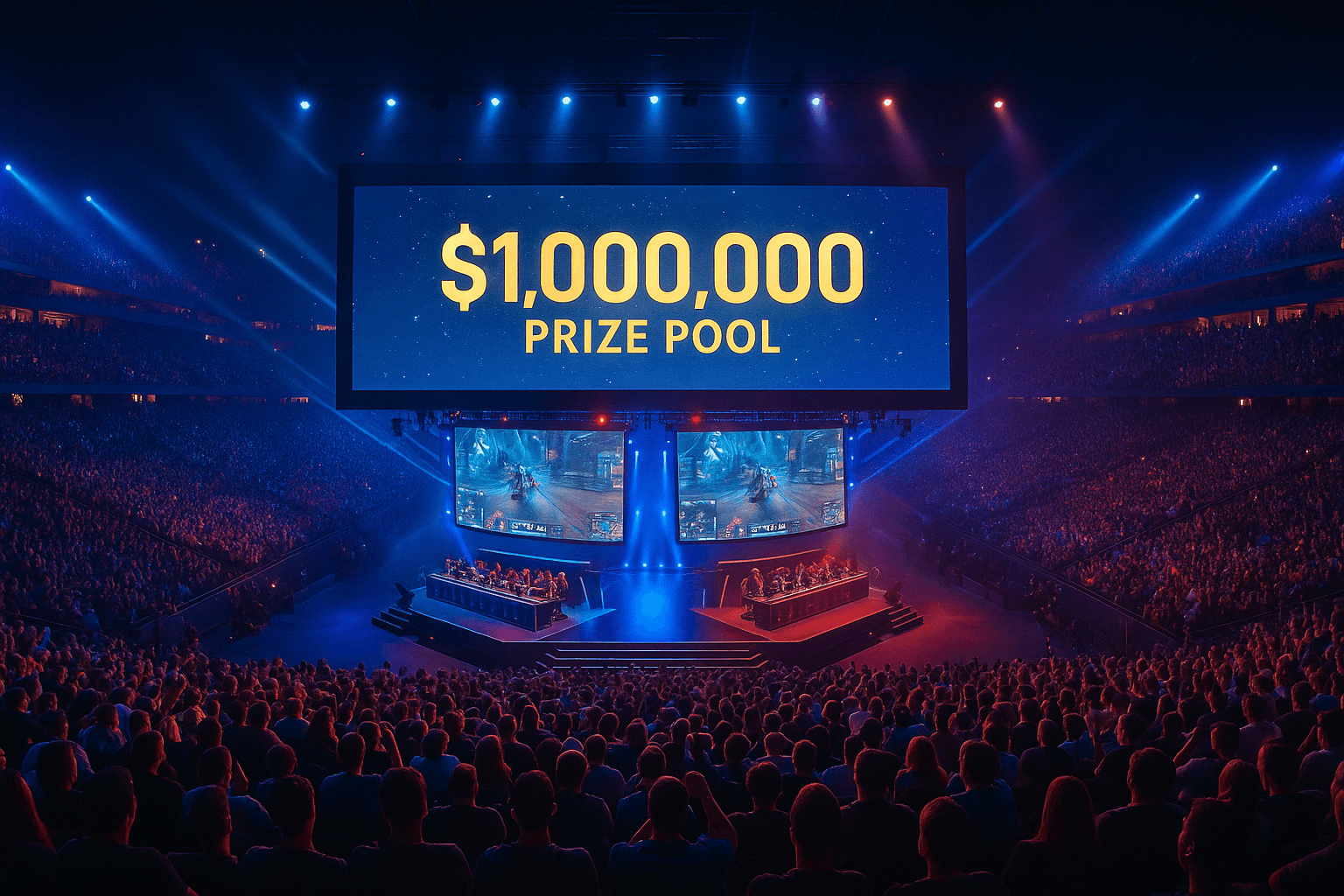

-The 2025 Esports World Cup in Riyadh featured 26 events across 25 titles, distributing a total USD 71.5 million prize pool, symbolizing the sector’s new scale and professionalism.

-Betting integration continues to expand. Riot Games recently approved gambling sponsorships for top-tier League of Legends and Valorant teams in select regions, marking a major policy shift.

-The Betify × Fnatic partnership exemplifies this trend, a multi-year deal embedding Betify within Fnatic’s ecosystem through branded content, match activations, and fan experiences.

-Another notable example is GG.Bet × NAVI, which integrates betting content directly into live broadcasts and co-created digital campaigns, bridging engagement between fans and betting audiences.

This ecosystem evolution attracts higher-tier investment and cements esports as a sophisticated, multi-layered entertainment economy.

Emerging Catalysts

-Brand diversification: non-endemic sectors such as finance, technology, and consumer goods are increasingly investing in esports, with other industries also showing interest as they recognize the opportunity to reach new, engaged audiences through gaming platforms.

-Event scale: multi-title events and global competitions like the Esports World Cup continue setting new benchmarks.

-Mainstream recognition: esports continues merging with mainstream entertainment, broadcast media, and even national sports initiatives.

The Tipping Point of Digital Entertainment

Esports has moved from novelty to necessity in digital culture. With projected revenues of USD 4.8 billion in 2025, nearly half tied to betting, and a user base on track to approach 896 million by 2029, the numbers alone demand attention.

What’s more, the nature of esports, interactive fandom, deep engagement, layered monetization, sets it apart from traditional entertainment. The infrastructure is maturing, the audiences are scaling, and the stakes are rising.

Sponsoring opportunities for iGaming brands

At Invixos, we offer tailored team sponsorship opportunities specifically for iGaming brands looking to deepen their presence in esports. Our expertise connects your brand with top esports organizations through strategic partnerships, delivering exclusive brand exposure, digital content collaborations, and live event activations.

Interested parties are encouraged to contact us directly to explore custom sponsorship packages and data-driven marketing solutions that align with your business goals in this high-growth space. You won’t want to miss the chance to be part of esports’ next wave of brand success.

Invixos contact details:

Steven Cartigny

steven.cartigny@invixos.com

+971 50 751 9026

Betsson Becomes Official Betting Partner of the Davis Cup

Betinia Expands Gamification Strategy with Diego Simeone ‘Football Manager’ Platform

Betty Expands Toronto Footprint with Argonauts and Toronto FC Deals

FeedConstruct Acquires Exclusive Global Rights to Argentine Basketball Leagues

Petro Pushes to Preserve Colombia’s Gambling VAT Amid Budget Pressure

2026 © Invixos. All rights reserved. A product by Jerom Verschoote.